Ceigall India Limited IPO Analysis: Ceigall India Limited is launching an IPO with a fresh issue of ₹684.25 crores and an offer for sale of ₹568.41 crores, totaling ₹1,252.66 crores. The IPO opens on August 1, 2024, and closes on August 5, 2024, with listing on August 8, 2024. This article provides a review of the Ceigall India Limited IPO, examining its strengths and weaknesses. Read on to learn more about the company.

About Ceigall India Limited

Established in 2002, Ceigall India is a prominent infrastructure construction company specializing in the development of flyovers, elevated roads, railway overbridges, tunnels, bridges, highways, runways, and expressways. With over 20 years of experience, the company has emerged as one of the fastest-growing players in the engineering, procurement, and construction (EPC) sector.

Ceigall India’s business model includes both Hybrid Annuity Model (HAM) and EPC projects, spanning over 10 states in India. As of June 30, 2024, the company’s Order Book was valued at ₹9,470.84 crore. Ceigall India has successfully completed 7 out of 16 EPC projects and has been recognized with bonuses for the early completion of 2 EPC projects and 1 HAM project.

As of March 31, 2024, the company is actively working on 1,488.17 lane km of projects and has completed 2,158.72 lane km of operations and maintenance (O&M) projects. Their operations span across Haryana, Punjab, Rajasthan, Uttar Pradesh, Jammu and Kashmir, Himachal Pradesh, Maharashtra, Jharkhand, and other regions.

Industry Overview

The Indian government is actively promoting infrastructure development through various schemes, with a significant emphasis on increasing capital expenditure (capex). The 2023-24 Budget Estimate for infrastructure capex reached ₹10 trillion, marking a nearly threefold increase compared to FY2019-20. In the 2024-25 Union Budget, the allocation for infrastructure was maintained at ₹11.11 trillion, which represents 3.4% of GDP.

This increase in infrastructure spending aligns with the government’s objective of fostering inclusive growth, as investment in infrastructure is expected to generate substantial long-term economic benefits.

Public sector capital expenditure is focused on enhancing national connectivity, with 64% of the total infrastructure capex allocated to highways and railways in FY24. Roads are crucial for transportation, handling 87% of passenger traffic and 60% of freight traffic. Although national highways make up only 2% of the road network, they carry 40% of the traffic.

In the first 10 months of FY24, the National Highways Authority of India (NHAI) authorized operations and maintenance (O&M) projects worth ₹77.21 billion, creating significant opportunities for engineering, procurement, and construction (EPC) companies. The government also collaborates with private sector players through public-private partnerships (PPP) to ensure efficient and comprehensive road connectivity.

The Ministry of Road and Highways budget has doubled from FY19 to FY24, reaching ₹2.64 trillion. For FY25, the budget increases by 3% to ₹2.72 trillion, which is expected to stabilize order books for road EPC companies in the upcoming fiscal year.

Financial Highlights

Ceigall India reported a significant increase in revenue from operations, reaching ₹3,029.35 crores in FY24, a 46.47% rise from ₹2,068.16 crores in FY23. The company’s net profits also saw a substantial improvement, rising 81.92% to ₹304.30 crores in FY24 from ₹167.27 crores in the previous year. This profit growth was driven by reduced construction costs, increased other income, and higher operational revenue.

In FY24, the earnings per share (EPS) rose to ₹19.37, an 81.87% increase from the previous year’s ₹10.65. This increase in EPS has enhanced shareholder value.

As a capital-intensive business, Ceigall maintained a total debt-to-equity ratio of around 1.17 times in FY24, consistent with the previous year’s 1.18 times.

The company’s Book to Bill Ratio for FY24 was 3.05 times, down from 5.23 times in FY23. While a higher ratio indicates better future order expectations, the decrease may reflect faster project execution relative to order book growth. The decline in the order book from FY23 is attributed to the nature of tenders and contracts received.

The Return on Equity (RoE) for Ceigall India was 33.57% in FY24, an improvement from 28.20% in FY23. This enhancement in returns is attributed to higher profits and a lower equity base. Considering their business operations, the Return on Capital Employed (RoCE) is also relevant, with the ratio improving to 31.98% in FY24 from 28.67% in FY23.

Ceigall India’s revenue from operations is categorized into Engineering, Procurement, and Construction (EPC) and Built, Operate, Transfer (BOT) and Annuity Projects. In FY24, the EPC segment contributed approximately 75% of the total revenue, Annuity Projects accounted for around 20.23%, and the remaining 4.76% came from other sources.

Competitors

Ceigall India’s listed peers include KNR Construction, J. Kumar Infraprojects, PNC Infratech, G R Infraprojects, H.G. Infra Engineering, and ITD Cementation India.

Ceigall India’s debt-to-equity ratio is around 0.58, which is on the higher side compared to its peers, whose ratios range from 0 to 0.58 in FY24. Along with ITD Cementation, Ceigall has a relatively higher ratio, reflecting its focus on capital-intensive business operations. In contrast, many of its peers have low or no debt, indicating a competitive advantage in sourcing their operations.

The EBITDA margin for Ceigall India was approximately 14.84% in FY24, comparable to its peers’ range of 10% to 20%. Ceigall’s margins are in line with its peers, with many peers at the higher end of this range. Notably, KNR Construction stands out among its peers for outperforming based on EBITDA margins.

Ceigall India’s return on equity (RoE) stands at around 31.52%, surpassing that of its peers. This higher RoE results from increased net profits year over year and a low equity base. The company has also outperformed its peers in terms of Return on Capital Employed (RoCE), indicating strong overall performance relative to its peers on various financial metrics.

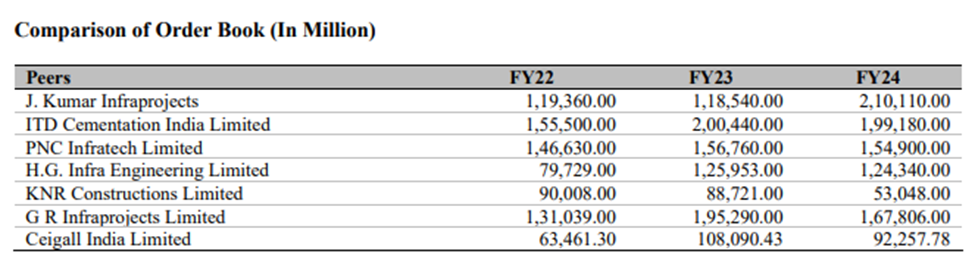

A comparative analysis of the order books of Ceigall India and its peers highlights the company’s position within the industry.

Source: RHP of the company

Strengths

- Rapid Growth: Ceigall India has experienced rapid growth, emerging as one of the fastest-growing EPC firms with a CAGR of 50.13% from 2021 to 2024. The company specializes in roads, highways, and complex structures like elevated roads and tunnels across various Indian states.

- Improving Order Book: The company maintains a robust order book, offering long-term revenue visibility. As of June 30, 2024, the order book was valued at ₹94,708.42 million, up 2.65% from Fiscal 2024, with 80.31% of the projects sourced from NHAI. This positions the company for a wider range of project tenders.

- Execution Capabilities: Ceigall India excels in project execution, having completed over 34 projects, including specialized structures. The company leverages in-house engineering expertise and efficient resource management to complete projects on or ahead of schedule, occasionally earning bonuses.

- Cost-Prudent Approach: The company employs a business model centered on careful project selection, cost optimization, and strategic pre-bidding approaches. This strategy has led to high returns on capital employed and equity, along with efficient inventory and equipment management.

- Experienced Management: Ceigall India benefits from seasoned leadership under promoter Ramneek Sehgal, who has over 20 years of industry experience. The management team’s expertise across various sectors enables the company to seize market opportunities and expand into new markets.

Weaknesses

- Government Contract Dependence: The company relies heavily on government contracts, particularly from the National Highways Authority of India (NHAI), which accounts for over 80% of its order book. This heavy dependence poses significant risks, especially if government policies or spending priorities change.

- Cash Flow Issues: The company has faced negative cash flows from operating activities in recent years. This trend may persist, potentially impacting its ability to meet working capital needs and repay loans without external financing, which could adversely affect business operations.

- Land Acquisition Challenges: Project delays are often caused by issues related to land acquisition, environmental clearances, or encroachments. Although these delays are typically customer-related, they can result in cost overruns, disputes, and financial losses for the company.

- Funding Projects: The company has high working capital requirements due to the need for project financing and performance guarantees. Insufficient cash flows to meet these needs or to service debt could negatively impact the company’s operations and profitability.

- Royalty Charges: Fluctuations in royalty charges for mining materials can adversely affect project costs and profitability. The company is required to pay these fees for materials like sand and stone, and any unfavorable changes in policy could increase expenses and reduce profit margins.

GMP

As of July 30th, 2024, Ceigall India Ltd’s shares were trading at a 22.44% premium in the grey market. The shares were priced at Rs. 491, reflecting a premium of Rs. 90 per share over the cap price of Rs. 401.

Key IPO Information

| Particulars | Details |

| IPO Size | Rs. 1,252.66 Cr |

| Fresh Issue | Rs. 684.25 Cr |

| Offer for sale (OFS) | Rs. 568.41 Cr |

| Opening date | 1 August 2024 |

| Closing date | 5 August 2024 |

| Face value | Rs. 5 |

| Price band | Rs. 380 – Rs. 401 |

| Lot size | 37 Shares |

| Minimum Lot Size | 1 Lot (37 Shares) |

| Maximum Lot Size | 13 Lots (481 Shares) |

| Listing date | 8 August 2024 |

Promoters: Ramneek Sehgal, Ramneek Sehgal and Sons HUF, and RS Family Trust.

Book Running Lead Manager: ICICI Securities Limited, IIFL Securities Private Limited and JM Financial Limited.

Registrar to the Offer: Link Intime India Private Limited

Conclusion Ceigall India Limited has a positive outlook due to its strong order book and improved project execution. However, the company’s negative operational cash flow is a concern. Diversifying their portfolio into other segments could help mitigate the risks associated with reliance on a single major client. Nevertheless, the presence of many established players competing for projects could increase competition, potentially impacting margins during industry downturns and periods of high inflation.