Allied Blenders and Distillers IPO Analysis: Allied Blenders and Distillers Limited is launching its Initial Public Offering. The IPO subscription begins on June 25, 2024, and ends on June 27, 2024. This article provides an in-depth analysis of Allied Blenders and Distillers IPO 2024, covering strengths, weaknesses, financials, and GMP. Stay tuned for more details!

About Allied Blenders and Distillers

Founded in 2008, Allied Blenders and Distillers Limited has established itself as India’s largest Indian-made foreign liquor (IMFL) company and the third-largest in terms of annual sales volumes from Fiscal 2014 to Fiscal 2022.

The company boasts a diverse product portfolio comprising 16 major brands of IMFL, encompassing whisky, brandy, rum, and vodka. Notably, brands like Officer’s Choice Whisky, Sterling Reserve, Officer’s Choice Blue, and ICONiQ Whisky have achieved ‘Millionaire Brands’ status by selling over a million 9-litre cases in a single year.

The company possesses a distillery in Rangapur, Telangana, spanning 74.95 acres with a constructed area exceeding 25,000 square meters. It also operates an internal distillation capacity of 600.00 lakh litres of extra neutral alcohol (“ENA”) annually, crucial for its manufacturing operations.

As of FY23, the company operates extensive bottling capabilities, encompassing a total of 32 facilities. This includes nine facilities owned and operated by the company itself, alongside arrangements with five third-party bottlers.

The company has achieved market leadership in the Indian alcoholic beverages sector, capturing an 8.2% market share in the Indian Made Foreign Liquor (IMFL) market based on sales volumes as of FY23.

Its sales network spans across 30 States and Union Territories in India, supported by 12 sales offices strategically located throughout the country. The company also possesses robust route-to-market capabilities.

Furthermore, Allied Blenders and Distillers has successfully exported its products to 14 international markets, including regions in the Middle East, North America, Africa, Asia, and Europe, enhancing its global footprint.

Industry Overview

The alcoholic beverage market in India has witnessed robust growth, with per capita consumption rising from 1.3 litres in 2005 to 3.2 litres in 2023. This expansion, bolstered by favorable demographic trends, positions India as a highly promising market poised for substantial future expansion.

Within the Indian alcoholic beverage market, Indian Made Foreign Liquor (IMFL) stands out as the largest segment both in terms of volume and value. In Fiscal 2023, IMFL sales totaled 395 million cases, marking a recovery from the pre-COVID levels of 355 million cases in Fiscal 2020.

Looking ahead, IMFL sales volume is projected to escalate to 520 million cases by Fiscal 2028. Concurrently, the sales value of IMFL was estimated at ₹2,206,620 million in Fiscal 2023 and is anticipated to surge to ₹3,371.89 billion by Fiscal 2028.

The projected growth trajectory indicates a Compound Annual Growth Rate (CAGR) of 9% in IMFL sales value and 5.7% in sales volume between Fiscal 2023 and Fiscal 2028, underscoring the sector’s resilience and expansion prospects in the Indian market.

Financial Highlights

Allied Blenders and Distillers has seen its operating revenues rise from ₹6,378.77 crores in FY21 to ₹7,105.68 crores in FY23. However, it’s crucial to note that nearly half of this revenue includes excise duty charges payable to the government.

In contrast, the company’s net profits have declined over the same period. From ₹2.5 crores in FY21, net profits fell to ₹1.6 crores in FY23, indicating tight profit margins.

These slim margins are largely due to the high excise duties and substantial borrowing costs faced by the company.

In the first nine months of FY24, Allied Blenders and Distillers recorded revenues of ₹5,911.14 crores and a net profit of ₹4.2 crores.

In FY23, the company posted an ROE of 0.39% and RoCE of 25.87%. The lower ROE reflects narrow margins as previously discussed. Conversely, the robust RoCE suggests efficient resource utilization.

Moreover, the company maintains a Net debt-to-equity ratio of 1.88, indicating significant reliance on borrowed capital for operations.

Competitors

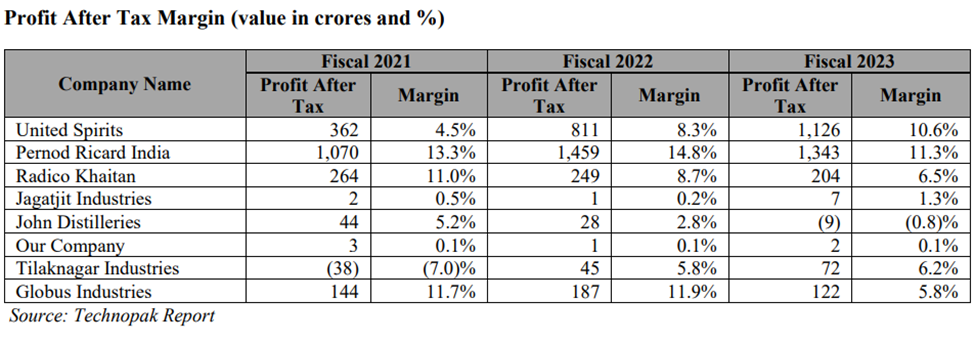

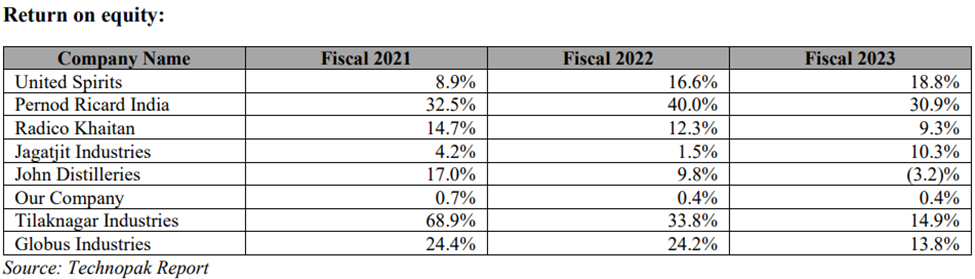

The Indian alcoholic beverage market is predominantly controlled by key players across IMFL, beer, and wine segments. The company encounters intense competition in the IMFL sector from both domestic and international firms. The following images display the competitors’ Profit After Tax (PAT) and Return on Equity (ROE) of Allied Blenders and Distillers.

Source: RHP of the company

Source: RHP of the Company

Strengths

- It is the largest Indian-owned IMFL company and the third-largest overall in India based on annual sales volumes from Fiscal 2014 to Fiscal 2022.

- Over the years, the company has diversified its product portfolio, evolving from a single-brand entity to a multi-product and multi-brand company spanning various categories of the IMFL sector in India.

- The company operates a widespread network of bottling facilities across India, facilitating local production at optimal costs and ensuring timely delivery to its distribution network while adhering to regulatory requirements.

- The Indian alcoholic beverage market is expanding, particularly in Tier II and Tier III cities, driven by urbanization, a growing middle class, and economic development. This positions the company well to capitalize on growth opportunities in the Indian IMFL industry.

Weaknesses

- Due to its heavy reliance on whiskey sales, which accounted for over 95% of its revenue in the past three fiscal years, any decline in whiskey sales could significantly impact the company’s operations.

- Operating in a competitive landscape dominated by players like United Spirits and Pernod Richard India, the company faces challenges in effectively competing, particularly in the whiskey segment, which could adversely affect its business.

- Fluctuations in taxes can directly impact product pricing, especially for whiskey, influencing consumer demand for alcoholic beverages.

- The company’s profitability is affected by varying state government regulations on alcohol pricing due to state-specific tax structures and policies. Changes in excise duties or increased production costs could potentially reduce profit margins.

- The company has unsecured loans, and the possibility of lenders demanding repayment at any time poses a risk, potentially impacting its ability to meet financial obligations promptly or at all.

GMP

Allied Blenders and Distillers Limited’s shares were traded at a 21.71% premium in the grey market on June 21, 2024, at Rs. 342, exceeding the cap price of Rs. 281 by Rs. 61 per share.

Key IPO Information

| Particulars | Details |

| IPO Size | Rs. 1,500.00 Cr |

| Fresh Issue | Rs. 1,000.00 Cr |

| Offer for sale (OFS) | Rs. 500.00 Cr |

| Opening date | June 25, 2024 |

| Closing date | June 27, 2024 |

| Face value | Rs. 2 per share |

| Price band | Rs. 267 – 281 per share |

| Lot size | 53 Shares |

| Minimum Lot Size | 1 Lot |

| Maximum Lot Size | 13 Lots (689 Shares) |

| Listing date | 2nd July, 2024 |

Promoters: Kishore Rajaram Chhabria, Bina Kishore Chhabria, Resham Chhabria Jeetendra Hemdev, Bina Chhabria Enterprises Private Limited, Bkc Enterprises Private Limited, Oriental Radios Private Limited And Officer’s Choice Spirits Private Limited

Book Running Lead Manager: ICICI Securities Limited, Nuvama Wealth Management Limited (formerly known as Edelweiss Securities Limited), ITI Capital Limited.

Registrar to the Offer: Link Intime India Private Limited

Conclusion

In this article, we examined the Allied Blenders and Distillers IPO Review 2024. The company holds a robust market position as India’s largest Indian-owned IMFL company, featuring a broad product range and expansive distribution network. However, challenges include narrow profit margins, heavy reliance on whiskey sales, and susceptibility to regulatory shifts.