Go Digit IPO Analysis: Go Digit is set to launch its IPO worth Rs. 2,614.65 Cr, commencing on May 15th, 2024. The offering will conclude on May 17th, with listing on the exchange slated for May 23rd, 2024. This piece will delve into the strengths and weaknesses of the Go Digit Ltd IPO for 2024. Stay tuned for insights!

About Go Digit

The company stands out as a top-tier full-stack insurance provider, utilizing technology to revolutionize the design, distribution, and customer service of non-life insurance products. Full-stack insurers are fully licensed and regulated by authorities, handling sourcing, underwriting, and servicing internally.

Digital full-stack insurers like Go Digit are insurance companies that prioritize incorporating technology into their operations. Presently, Go Digit provides a range of insurance products including motor, health, travel, property, marine, liability, and others, all customizable to suit individual customer requirements.

In its capacity as a digital full-stack insurance enterprise, Go Digit utilizes a blend of insurance and technology solutions for tasks such as enrollment, claims processing, underwriting, policy administration, data analysis, and fraud detection.

As per the findings of the RedSeer Report commissioned by Go Digit specifically for this RHP, Go Digit emerges as the swiftest-growing insurer among private non-life insurers in terms of Gross Written Premium (GWP) during FY22 and FY23.

As of December 31, 2023, Go Digit had amassed a customer base of 43 million individuals who have benefited from its insurance services since the company’s establishment in 2017. Among these, 28 million customers were acquired through motor insurance, 15 million through health insurance, and 500,000 through other insurance offerings.

Industry Overview

India boasts one of the largest cohorts of young, working-age individuals, with approximately 970 million people aged between 15 and 64, constituting around 68.0% of the country’s total population as of 2023, according to Redseer estimates derived from data provided by the Economic and Social Commission for Asia and the Pacific (ESCAP).

There’s a significant transformation occurring in Indian households regarding their income and spending habits, particularly with the rapid growth expected in high-income households between CY23 and CY28, projected at a CAGR of 7.2%. By CY28, it’s anticipated that the number of high-income households will reach 58 million, making up about 16% of all households in India. This marks a substantial rise from their current representation of 12.1%.

By FY23, the non-life insurance market reached US$ 33.30 billion in Gross Written Premium (GWP), according to the General Insurance Council. This implies a non-life insurance penetration rate of 1.0%, signaling ample opportunity for enhancement.

The average insurance penetration across major global economies stood at 4.0%. In 2022, China’s penetration rate was 1.9%, while the United States boasted a penetration rate of 9.0%.

Furthermore, India’s non-life insurance density stood at US$ 23.00 as of FY23, measured by premium per capita, marking the lowest figure among several of the world’s largest markets, with the global average at US$ 499.00 as of CY22.

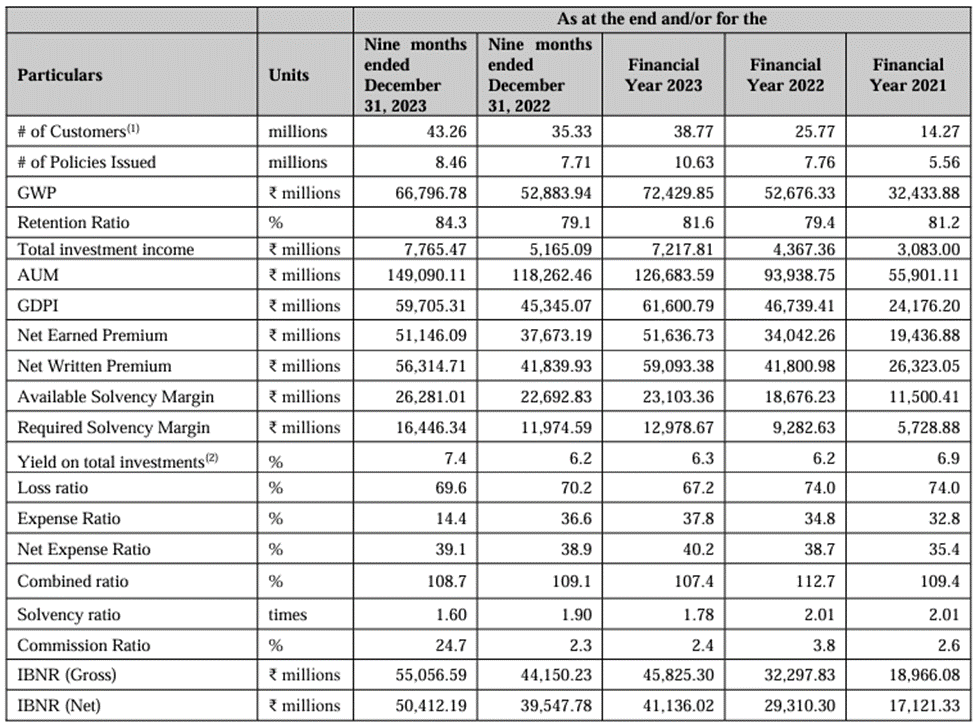

Financial Highlights

As of FY23, Go Digit Insurance recorded Gross Written Premiums totaling Rs. 7,243 Cr, marking a 38% increase from Rs. 5,268 Cr in FY22. Gross Written Premiums have maintained a CAGR growth of 49% since FY21.

Conversely, net premiums experienced a slightly higher growth rate of 41.37%, rising from Rs. 4,180 Cr in FY22 to Rs. 5,909 Cr in FY23. This can be attributed to a reduction in the number of insurance policies rewritten by other insurance providers.

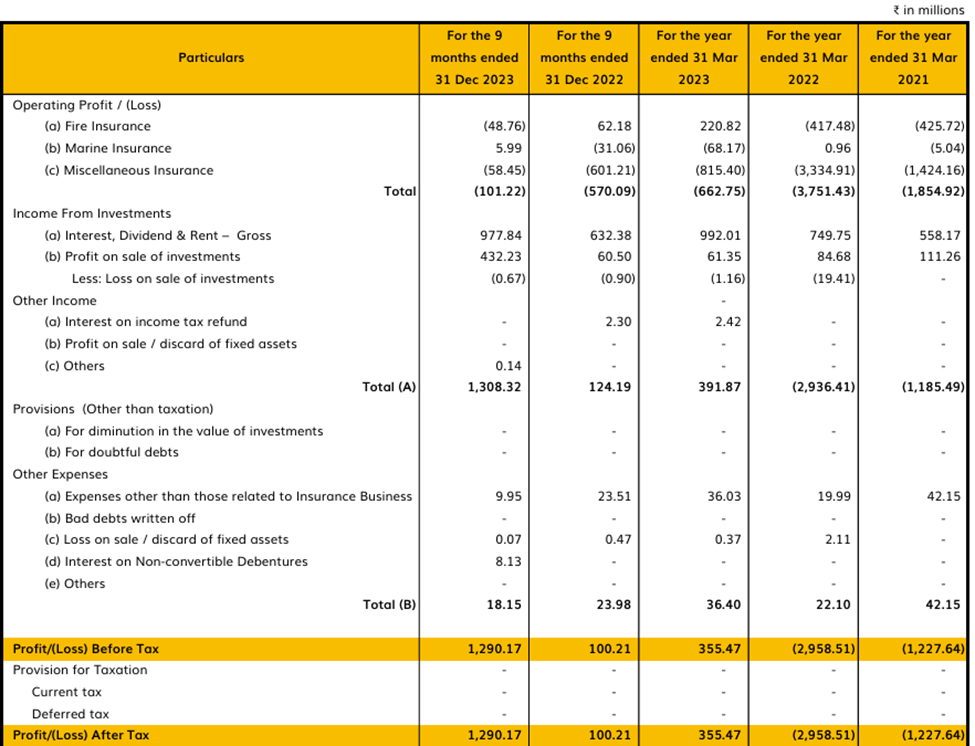

In FY23, Go Digit incurred an operating loss of Rs. 66.27 Cr, a substantial decrease from Rs. 375.14 Cr in the previous fiscal year. However, due to reduced provisions, the company ultimately achieved a profit of Rs. 35.5 Cr in FY23, contrasting with a loss of Rs. 295.85 Cr in FY22.

The insurance provider disclosed a Combined Ratio of 107%, marking a significant decline of 530 points compared to the previous year. The Combined Ratio serves as a gauge of the insurer’s underwriting profitability. It is computed by summing the loss and expense ratios, with a ratio exceeding 100% indicating that the company is paying out more in claims and expenses than it is collecting in premiums. The commission ratios of the company provide insight into how much is spent on commissions to earn Rs. 100 in premiums. In FY23, Go Digit reported a commission ratio of Rs. 2.4. However, within the initial nine months of FY24 alone, the commission ratio surged to 24.7%, contrasting sharply with the 2.3% recorded in the corresponding period of FY23.

Source: RHP of the Company

Source: RHP of the Company

Competitors

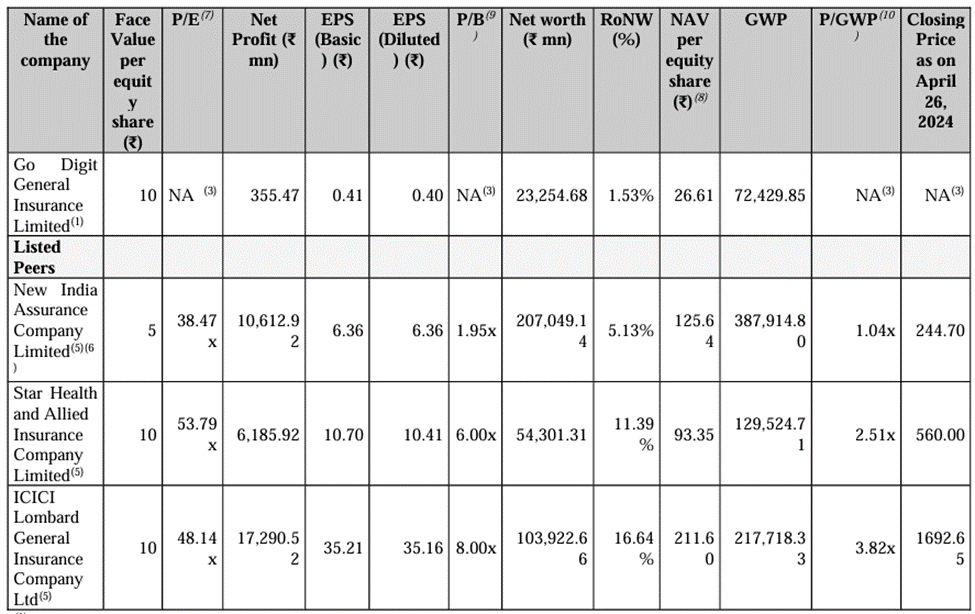

As a non-life insurer, Go Digit falls within the general insurance sector, where it shares the space with peers such as New India Assurance Company, Star Health & Allied Insurance Company, and ICICI Lombard General Insurance Company.

Among the peers, Go Digit stands as the smallest company, boasting a net worth of only Rs. 2325 Cr, significantly lower than the industry giant New India Assurance Company, which holds a net worth of Rs. 20,705 Cr. Among the three peers, Star Health & Allied Insurance Company has the highest Price-to-Earnings ratio of 54x and a Price-to-Gross Written Premium ratio of 2.51x.

Nevertheless, ICICI Lombard leads in Return on Net Worth, just under 17%, and trades at a Price-to-Gross Written Premium ratio of Rs. 3.82x.

Source: RHP of the Company

Strengths

- Simple & Tailored Customer Experience: Go Digit prioritizes customer experience, simplifying insurance processes to achieve high customer satisfaction, evident in its Net Promoter Score.

- Relationship with Distributors: The company invests time and resources in fostering relationships with various distributors, including individual agents, corporate agents, motor insurance service providers, and brokers.

- Predictive Underwriting Models: Go Digit utilizes gathered data and expertise in motor insurance to accurately assess risks and predict losses at a granular level, aiding in cost management and potentially lowering premiums for customers.

- Advanced Technology Platform: Leveraging advanced technology, Go Digit employs an entirely cloud-based platform powered by AI and machine learning, utilizing a vast data bank to make algorithm-driven strategic decisions efficiently.

Weaknesses

- Lack of Profitable Track Record: Go Digit has not maintained consistent profits over the past three financial years, only achieving profitability in FY23.

- Estimation-based Loss Reserves: The reserves maintained by the insurer rely on estimates of future claim liabilities, potentially leading to inadequacy in case of unforeseen events.

- Impact of Natural Calamities: Being a general insurer, Go Digit is inherently exposed to catastrophic events like natural disasters and terrorist attacks, which can adversely affect its financial standing if insured parties are affected.

- History of Regulatory Warnings: In recent times, Go Digit has been cautioned and received warnings and show-cause notices from the IRDAI due to non-compliance with regulatory requirements.

GMP

On May 13, 2024, Go Digit shares traded at a premium of 19.49% in the grey market, reaching Rs 325 per share. This represents a premium of Rs 53 per share over the capped price of Rs 272.

Key IPO Information

| Particulars | Details |

| IPO Size | Rs. 2614.65 |

| Fresh Issue | Rs. 1125 |

| Offer for sale (OFS) | Rs. 1489.65 |

| Opening date | 15 May 2024 |

| Closing date | 17 May 2024 |

| Face value | Rs. 10 |

| Price band | Rs. 258 – 272 |

| Lot size | 55 Shares |

| Minimum Lot Size | 1 Lot (55 Shares) |

| Maximum Lot Size | 13 Lots (715 Shares) |

| Minimum Investment | Rs. 14,960 |

| Listing date | 23 May 2024 |

Promoters: Kamesh Goyal, Go Digit Infoworks Services Pvt Ltd, Oben Ventures LLP and FAL Corporation

Book Running Lead Manager: ICICI Securities Ltd, Morgan Stanley India Company Pvt Ltd, Axis Capital Ltd, HDFC Bank Ltd, IIFL Securities Ltd and Nuwama Wealth Management Ltd.

Registrar to the Offer: Link Intime India Pvt Ltd

Conclusion

In summary, Go Digit’s forthcoming IPO offers an opportunity to invest in one of India’s swiftest-growing private non-life insurers. The company’s emphasis on technology integration, streamlining customer experiences, and forging robust distributor relationships stands out as significant strengths.

Nevertheless, prospective investors must weigh certain weaknesses, including the company’s inconsistent profitability, reliance on estimated loss reserves, susceptibility to catastrophic events, and past regulatory admonitions.

Ultimately, the triumph of Go Digit’s IPO and its future expansion hinge on its capacity to sustain technological innovation, adeptly mitigate risks, and consistently deliver exceptional customer service within the fiercely competitive non-life insurance sector.