Hyundai Motor India IPO Analysis: Hyundai Motor India Limited is launching an IPO valued at Rs. 27,870.16 crore, consisting entirely of an offer-for-sale. The IPO will open for subscription on 15th October 2024 and close on 17th October 2024, with the listing set for 22nd October 2024. In this article, we will provide a comprehensive review of the Hyundai Motor India Limited IPO, examining its key strengths and potential weaknesses. Let’s dive in!

About Hyundai Motor India

Hyundai Motor India Limited (HMIL), established on May 6, 1996, is headquartered in Gurugram, Haryana, and operates as a subsidiary of South Korea’s Hyundai Motor Company. Over the years, HMIL has grown into one of India’s leading automotive manufacturers.

Since 2009, Hyundai has consistently held the position of the second-largest passenger vehicle manufacturer in India by sales volume. With two integrated plants in Chennai and a newly acquired facility in Talegaon, the company continues to expand its production capacity. By June 2024, HMIL had sold over 12 million passenger vehicles across domestic and export markets. The company pays a 3.5% royalty on revenue to its parent company, covering vehicle and parts sales.

Hyundai has played a significant role in the Indian automotive industry, holding a market share of 14-17% in passenger vehicle sales. It exports its vehicles to over 190 countries, including Europe, Africa, and Asia. Hyundai also maintains a strong presence in India with 1,377 sales points and 1,561 service points nationwide.

The company offers a broad range of passenger vehicles, including sedans, hatchbacks, and SUVs, with popular models like the Hyundai Venue, Creta, and i20. Hyundai has also entered the electric vehicle market with models like the Kona and Ioniq 5, alongside manufacturing key components such as transmissions and engines. HMIL emphasizes cutting-edge technology and safety features, ensuring a high level of customer satisfaction.

Industry Overview

The Indian automobile industry plays a pivotal role in the country’s economy, contributing 7.1% to the GDP and ranking as the third-largest market worldwide. In FY2024, the industry produced 28.43 million vehicles, encompassing passenger cars, two-wheelers, and more.

By 2029, the industry’s value is forecasted to reach $187.85 billion, growing at a strong CAGR of 8.20% from $126.67 billion in 2024. The passenger vehicle market in India is set to expand from $39.82 billion in 2024 to $54.76 billion by 2030, marking a CAGR of 5.45%.

With projected passenger vehicle sales of 4 million units in 2024, India’s market is thriving. The government aims for 30% of new vehicle sales to be electric by 2030, promoting sustainable mobility and further boosting the electric vehicle sector.

Financial Highlights

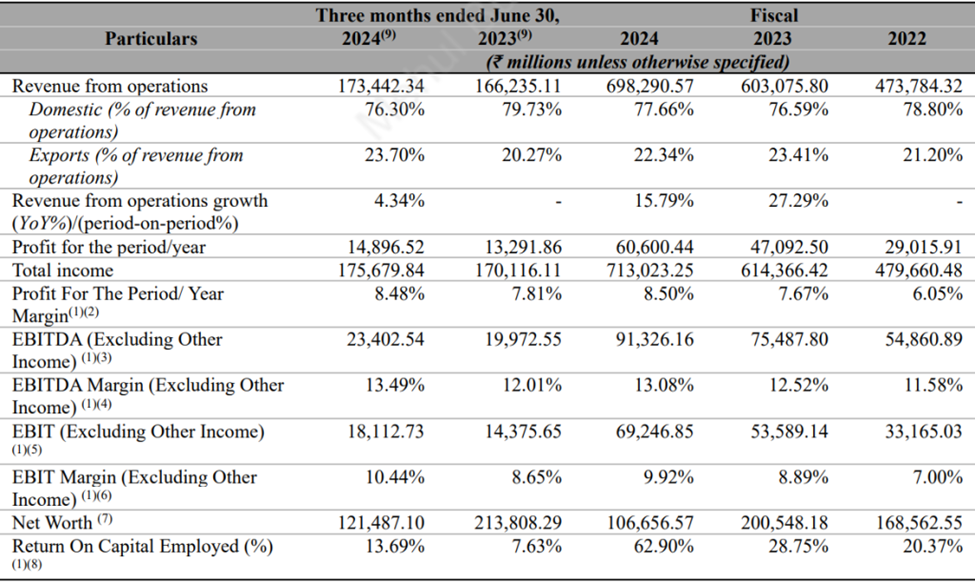

Source: Hyundai Motor India Limited RHP

Hyundai Motor India Limited’s financial performance has shown significant growth. The company’s revenue rose from ₹60,307.58 crore in FY23 to ₹69,829.06 crore in FY24, marking a 15.79% increase. In Q1 FY25, Hyundai reported revenue of ₹17,344.23 crore. Over the last two years, the company’s revenue has grown at a CAGR of 21.40%.

In FY24, 77.66% of Hyundai’s revenue came from India, 3.53% from Africa, 6.66% from Latin America, and 11.21% from the Middle East and Europe. Vehicle sales contributed 85.98% of total revenue, parts accounted for 6.18%, services for 6.07%, and other operating income for 1.77%.

The company sold 7,77,876 vehicles in FY24, with 6,14,721 units sold domestically and 1,63,155 units exported. Hyundai’s net profit grew by 28.68%, from ₹4,709.25 crore in FY23 to ₹6,060.04 crore in FY24. In Q1 FY25, net profit stood at ₹1,489.65 crore, and the company achieved a CAGR of 44.52% in net profit over the past two years.

Hyundai’s EBITDA margin improved from 12.52% in FY23 to 13.08% in FY24, while the PAT margin increased from 7.67% to 8.50%. Additionally, ROCE saw a dramatic rise from 28.75% in FY23 to 62.90% in FY24, driven by dividend payments to the parent company, reducing net worth. The company also lowered its borrowings from ₹1,158.6 crore in FY23 to ₹767.92 crore in FY24, with further reductions to ₹758.14 crore in Q1 FY25.

Competitors

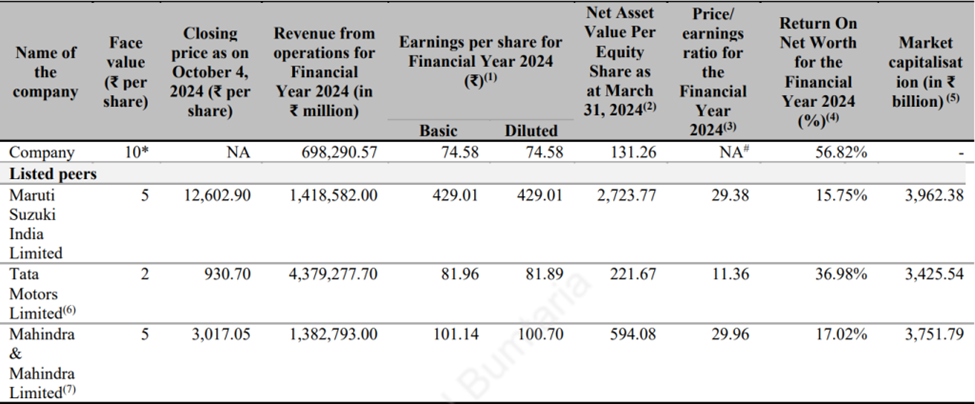

Hyundai Motor India Limited faces competition from peers like Maruti Suzuki India Limited, Tata Motors Limited, and Mahindra & Mahindra Limited. While Hyundai’s revenue trails behind these competitors in the stock market, it excels with a remarkable return on net worth of 56.82%. This figure significantly surpasses those of its rivals: Maruti Suzuki at 15.75%, Tata Motors at 36.98%, and Mahindra & Mahindra at 17.02%.

This performance highlights Hyundai’s superior ability to generate profits from its shareholders’ equity compared to other leading players in the Indian automotive sector. The images below provide a comparison of Hyundai Motor India Limited with its peer competitors.

Source: Hyundai Motor India Limited RHP

Strengths

- Market Leader: Since FY09, Hyundai Motor India has maintained its position as the second-largest passenger vehicle manufacturer in the country, demonstrating consistent leadership and strong brand equity.

- Varied Product Range: Hyundai provides 13 different models across various segments, including sedans, hatchbacks, SUVs, and electric vehicles, appealing to a wide range of consumers.

- Cutting-Edge Technology: The company has a track record of launching industry-first innovations such as connected car technology (Bluelink), daytime running lights, and advanced safety features, which enhance its appeal in the market.

- Export Leader: Hyundai exports to over 190 countries, making a significant contribution to India’s passenger vehicle exports and enhancing its global footprint.

- Strong Manufacturing Capabilities: The Chennai facility ranks among India’s largest, with an annual production capacity of 824,000 units, enabling large-scale manufacturing to support the company’s growth.

- Valuable Brand Recognition: Hyundai is recognized as one of the top 32 most valuable brands in the world, with sustained growth over the years.

- Extensive Dealer Network: Hyundai boasts a robust sales network with 1,377 outlets and 1,561 service centers throughout India.

Weaknesses

- Dependence on Domestic Market: A large portion of revenue is generated in India, which exposes the company to risks from local economic downturns and regulatory changes.

- Cybersecurity Vulnerabilities: Recent data breaches have eroded customer trust, highlighting the urgent need for enhanced cybersecurity measures to safeguard sensitive information.

- Limited EV Portfolio: Hyundai’s electric vehicle lineup in India is restricted, primarily featuring higher-end models like the Ioniq 5, which limits its appeal to a broader consumer base.

- Over-dependence on SUVs: While the SUV segment performs well, excessive reliance on this category may put the company at risk if consumer preferences shift.

- High Competition in Compact Cars: Hyundai Motor India faces fierce competition in the compact car segment from established brands, making it challenging to maintain market leadership.

- Market Share Decline in Sedans: Despite having a diverse vehicle portfolio, Hyundai Motor India has experienced a decrease in market share within the sedan segment as SUVs gain popularity.

- Limited Luxury Vehicle Offerings: Hyundai mainly targets the mass-market segment, which restricts its attractiveness to luxury car buyers who favor premium brands like BMW and Audi.

GMP

As of October 9, 2024, Hyundai Motor India Limited’s shares were trading in the grey market at a 7.40% premium, priced at Rs 2,105. This reflects a premium of Rs 145 per share over the cap price of Rs 1,960.

Key IPO Information

| Particulars | Details |

| IPO Size | Rs 27,870.16 crore |

| Offer for Sale (OFS) | Rs 27,870.16 crore |

| No of Shares | 14.22 crore |

| Opening date | October 15, 2024 |

| Closing date | October 17, 2024 |

| Face value | ₹10 per share |

| Price band | ₹1865 to ₹1960 per share |

| Lot size | 7 Shares |

| Minimum Lot Size | 1 (7 Shares) |

| Maximum Lot Size | 14 (98 Shares) |

| Listing date | October 22, 2024 |

Promoters: Hyundai Motor Company

Book Running Lead Manager: Kotak Mahindra Capital Company Limited, Citigroup Global Markets India Private Limited, HSBC Securities and Capital Markets (India) Private Limited, J.P. Morgan India Private Limited, Morgan Stanley India Company Private Limited

Registrar to the Offer: KFin Technologies Limited

Conclusion

In summary, Hyundai Motor India Limited maintains a solid market presence and a forward-thinking approach in the automotive sector. The company boasts a strong brand and a varied product lineup, featuring popular models across different segments. Hyundai’s dedication to quality and cutting-edge technology boosts its attractiveness to consumers.

With a strong manufacturing network and numerous sales outlets, the company is well-prepared to meet increasing demand. As it approaches this crucial financial milestone, Hyundai is actively enhancing its footprint in both domestic and global markets.