KRN Heat Exchanger and Refrigeration IPO Analysis: KRN Heat Exchanger and Refrigeration Limited is set to launch an IPO worth ₹341.95 crore. The fresh issue will open on September 25, 2024, and close on September 27, 2024, with a listing date on October 3, 2024. In this article, we will review the KRN Heat Exchanger and Refrigeration Limited IPO, examining its strengths and weaknesses. Let’s dive in!

About KRN Heat Exchanger and Refrigeration

KRN Heat Exchanger and Refrigeration Limited is set to launch an IPO valued at ₹341.95 crore, opening for subscription on September 25, 2024, and closing on September 27, 2024. The shares are expected to be listed on the exchange on October 3, 2024. This article will provide an overview of the KRN Heat Exchanger and Refrigeration Limited IPO, assessing its strengths and weaknesses.

As a prominent manufacturer of fin and tube-type heat exchangers, KRN caters to the HVAC and refrigeration sectors. The company offers a diverse range of products, including copper and aluminum fins, copper tubes, water coils, condenser coils, and evaporator coils, suitable for domestic, commercial, and industrial use. KRN produces heat exchanger tubes in various diameters, from 5 mm to 15.88 mm, ensuring a comprehensive product offering.

With a modern manufacturing facility in Neemrana, Rajasthan, spanning 7,800 sq. meters, KRN utilizes advanced technology to deliver customized solutions that adhere to international quality standards. The company has established a robust presence in both domestic and international markets, exporting products to countries such as the UAE, USA, Italy, Saudi Arabia, Norway, Czech Republic, UK, and Germany. Serving esteemed clients like Daikin India, Schneider Electric, and Carrier, KRN is poised for success, with projected export revenues of $8.75 million and domestic sales of $26.25 million for the 2023-24 fiscal year.

Industry Overview

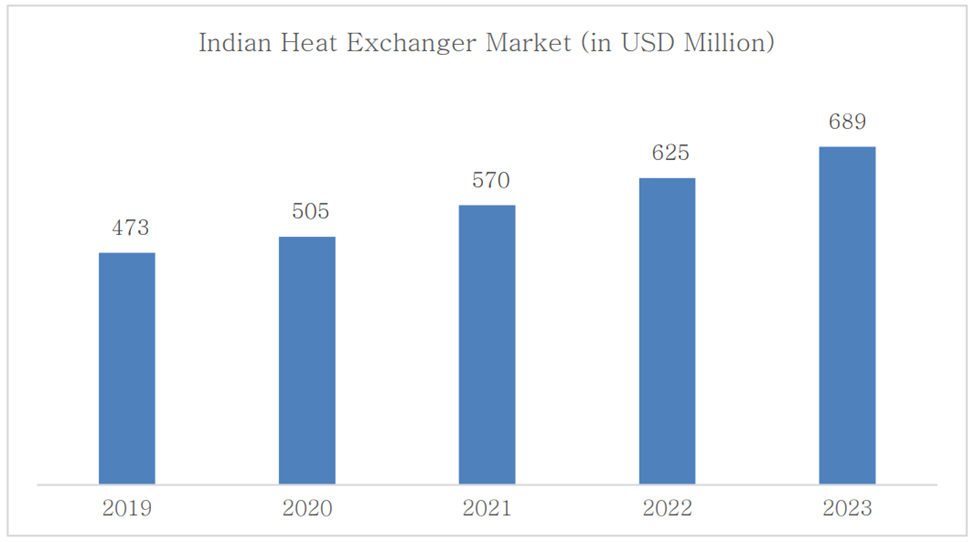

The Indian heat exchanger industry has shown impressive growth, increasing from USD 625 million in 2022 to USD 689 million in 2023, reflecting a compound annual growth rate (CAGR) of 10% from 2019 to 2023. Although the sector faced a slowdown in 2020 due to the pandemic, it rebounded strongly, achieving an average annual growth rate of 11% from 2021 to 2023. This growth is primarily fueled by rapid industrialization, urbanization, and infrastructure development. The industry’s wide range of applications across key sectors—including chemical manufacturing (21.4%), oil and gas (20%), power and energy (15.4%), HVAC (14.9%), metal (8.2%), and others (20.1%)—ensures ongoing demand and significant growth potential.

Source: Company RHP

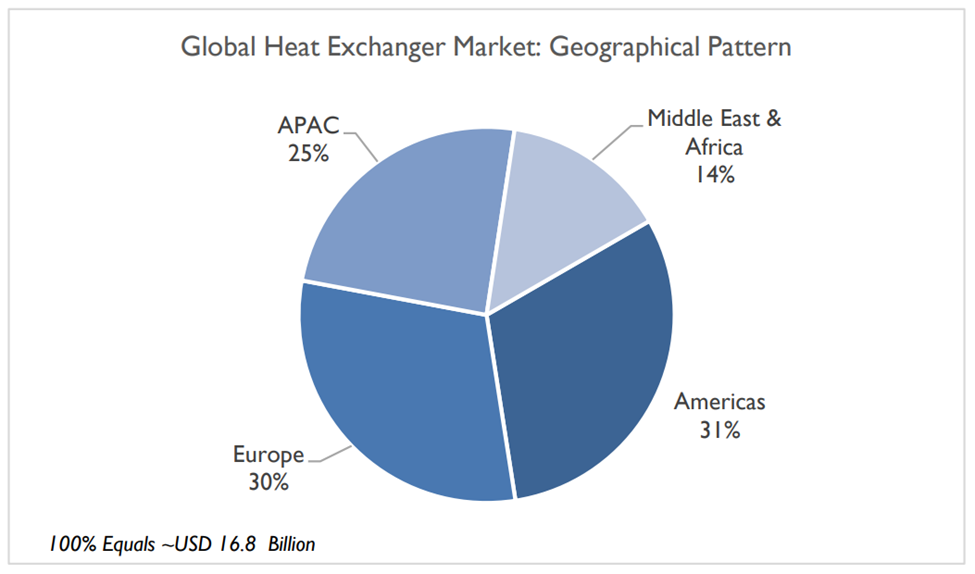

The global heat exchanger industry has expanded at a CAGR of 6.4% from FY19 to FY23, reaching USD 16.8 billion by 2023. The images below illustrate the geographical distribution of the global heat exchanger market.

Source: Company RHP

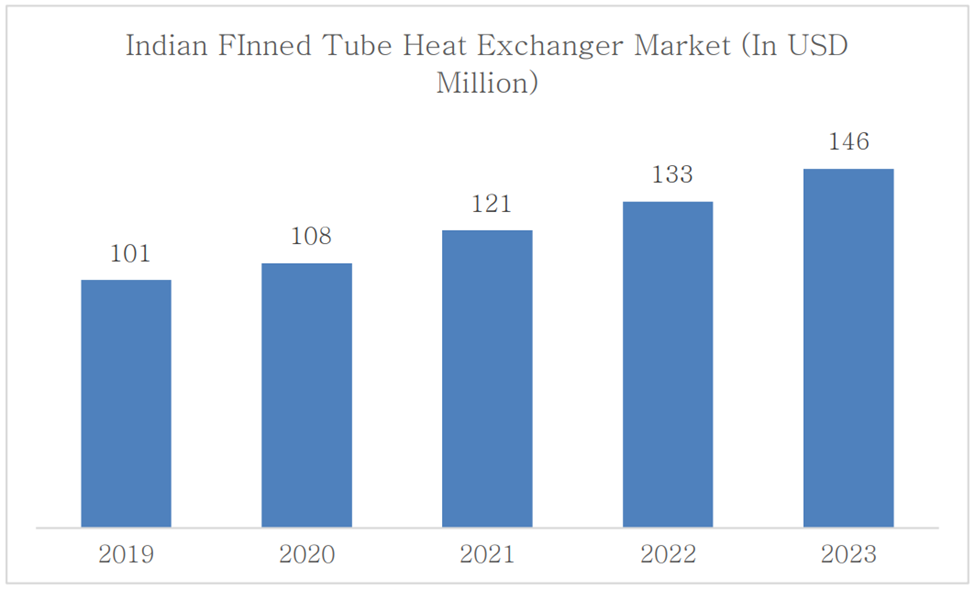

Finned tube heat exchangers represent the second-largest segment in the Indian heat exchanger market, contributing to around 20% of the total industry revenue. Their market value rose from USD 133 million in 2022 to USD 146 million in 2023. The industry has experienced a compound annual growth rate (CAGR) of approximately 10.7% between 2020 and 2023.

The growing demand for energy-efficient cooling solutions has contributed to the rise of finned tube heat exchangers. The images below illustrate the Indian finned tube heat exchanger market from 2019 to 2023.

Source: Company RHP

Financial Highlights

Source: Company RHP

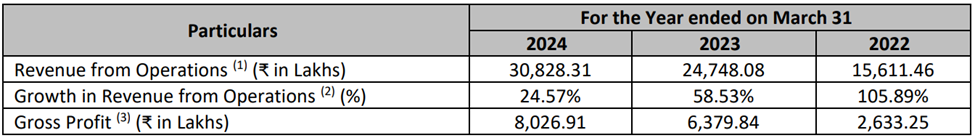

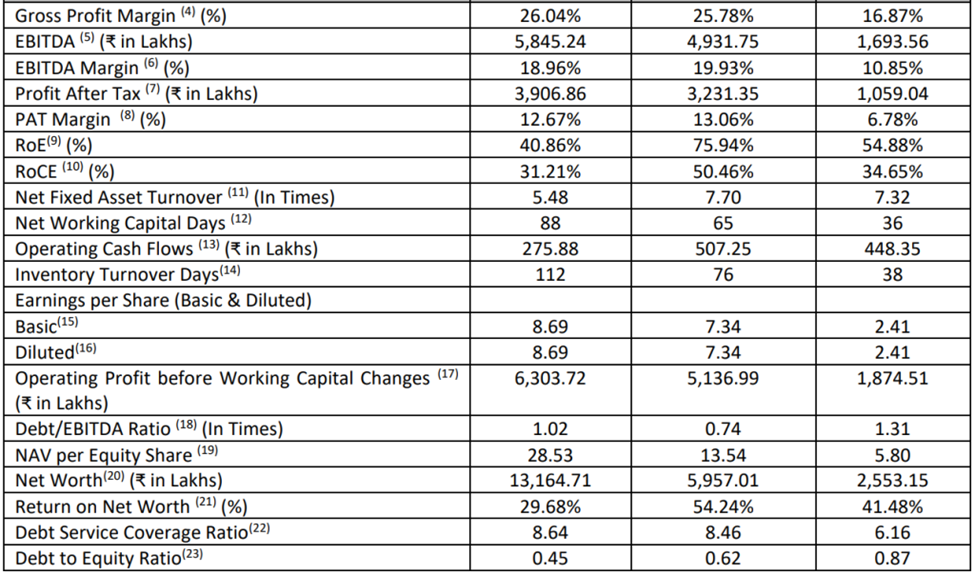

KRN Heat Exchanger and Refrigeration Limited saw significant growth in its revenue, increasing from ₹247.48 crores in FY23 to ₹308.28 crores in FY24, marking a 24.57% rise year-on-year. Over the past two years, the company has achieved a strong compound annual growth rate (CAGR) of 40.51% in revenue.

The company’s revenue distribution in FY24 shows that evaporator coils contributed 37.49%, condenser coils 55.24%, headers and copper parts 1.52%, sheet metal parts 0.05%, and other operating revenue 5.71%. Geographically, KRN generated 85.32% of its revenue from India, 2.57% from Europe, 3.46% from North America, and 8.66% from Asia (excluding India).

KRN Heat Exchanger and Refrigeration Limited’s net profit saw a remarkable jump from ₹10.59 crore in FY22 to ₹32.31 crore in FY23, representing a 205.1% increase. The growth continued in FY24, with net profit reaching ₹39.07 crore, a 20.92% rise. Over the past two years, the company’s net profit has grown at an impressive CAGR of 88.29%.

However, the company faced a slight decline in its profitability margins. The EBITDA margin dropped from 19.83% in FY23 to 18.96% in FY24, while the PAT margin also decreased from 13.06% in FY23 to 12.67% in FY24.

In terms of financial ratios, KRN’s return on equity (ROE) fell from 75.94% in FY23 to 40.86% in FY24. Similarly, the return on capital employed (ROCE) declined from 50.46% to 31.21%. On a positive note, the company improved its debt-to-equity ratio, reducing it from 0.62x in FY23 to 0.45x in FY24.

Note: The FY24 figures provided by the company are on a consolidated basis, whereas the numbers for FY23 and FY22 were reported on a standalone basis.

Competitors

KRN Heat Exchanger and Refrigeration Limited has no listed peer companies in the Indian stock market, as stated in its RHP.

Strengths

- Strategic Customer Relationships: Strong partnerships with major OEMs like Daikin drive revenue and enhance credibility, supporting market expansion.

- Export Market Growth: 14.68% of revenue in FY 2024 came from exports, offering diversification and growth beyond India.

- In-House Manufacturing and Testing: A well-equipped facility enables cost control and quality assurance, providing a competitive advantage.

- Technological Advancements: Investments in advanced machinery boost manufacturing capabilities, allowing rapid scaling and product diversification.

- Manufacturing Expansion: In 2023, the new subsidiary KRN HVAC Products expanded the product portfolio, focusing on high-value items like bar and plate heat exchangers.

- Expanding Global Footprint: Exports to Asia and North America are driving future revenue growth, with a focus on international markets.

Weaknesses

- Customer Concentration Risk: 60–70% of revenue comes from the top 10 clients, making the company vulnerable if key clients, like Daikin, reduce business.

- Intense Competition: The heat exchanger market faces tough competition from global players like Alfa Laval and Danfoss, pressuring margins.

- Capital-Intensive Expansion: Ongoing expansion increases financial strain, especially with reliance on debt, limiting flexibility for future growth.

- Geopolitical and Market Risks: International growth, particularly in Europe and APAC, exposes the company to geopolitical risks and currency fluctuations, impacting profitability.

- Raw Material Price Volatility: Dependency on non-ferrous metals like copper and aluminum makes the company susceptible to fluctuating material costs, affecting profit margins.

- Limited Brand Recognition: Despite strong client relations, KRN lacks widespread brand recognition compared to global competitors, potentially hindering growth in new markets.

GMP

As of September 23rd, 2024, shares of KRN Heat Exchanger and Refrigeration Limited were trading at a 101.36% premium in the grey market. The shares were priced at ₹443, reflecting a ₹223 premium over the cap price of ₹220.

Key IPO Information

| Particulars | Details |

| IPO Size | Rs 341.95 crore |

| Fresh Issue | Rs 341.95 crore |

| No of Shares | 1.55 crore |

| Opening date | September 25, 2024 |

| Closing date | September 27, 2024 |

| Face value | ₹10 per share |

| Price band | ₹209 to ₹220 per share |

| Lot size | 65 Shares |

| Minimum Lot Size | 1 (65 Shares) |

| Maximum Lot Size | 13 (845 Shares) |

| Listing date | October 3, 2024 |

Promoters: Mr. Santosh Kumar Yadav, Mrs. Anju Devi, and Mr. Manohar Lal.

Book Running Lead Manager: Holani Consultants Private Limited

Registrar to the Offer: Bigshare Services Private Limited

Conclusion

KRN Heat Exchanger and Refrigeration Limited has emerged as a promising player in the growing HVAC&R industry. Specializing in fin and tube-type heat exchangers, the company is well-positioned for future growth. Its global presence and strong relationships with key clients lay a solid foundation for expansion, while its focus on technological advancements gives it a competitive edge. Strategic investments in manufacturing further underscore KRN’s forward-thinking approach.

The upcoming IPO for KRN Heat Exchanger and Refrigeration Limited presents a compelling opportunity for investors to tap into the dynamic heat exchanger market. With an expanding product portfolio and an innovative business approach, the company is well-poised for long-term success. KRN offers an exciting investment opportunity for those looking to support industrial innovation.